Last Updated: December 2025 | Reading Time: 12 minutes

| FARE Act Quick Facts Effective: June 11, 2025 | Est. Savings: $5,400+ per renter | Violations: $750-$2,000 fines |

FARE Act broker fee ban changes took effect June 11, 2025, fundamentally reshaping NYC’s rental market. If you are searching for an apartment in Brooklyn or Staten Island, understanding this law is not optional – it is the difference between keeping thousands of dollars in your pocket and paying fees you no longer owe.

Before this law, NYC renters routinely paid broker fees of 12-15% of annual rent – often $5,000 to $8,000 or more – for services they never requested. The broker worked for the landlord, listed the apartment on the landlord’s behalf, but somehow the renter paid the tab. That practice is now illegal in most rental scenarios.

Here is what Brooklyn and Staten Island renters need to know to protect themselves, spot workarounds, and take action if someone tries to charge illegal fees.

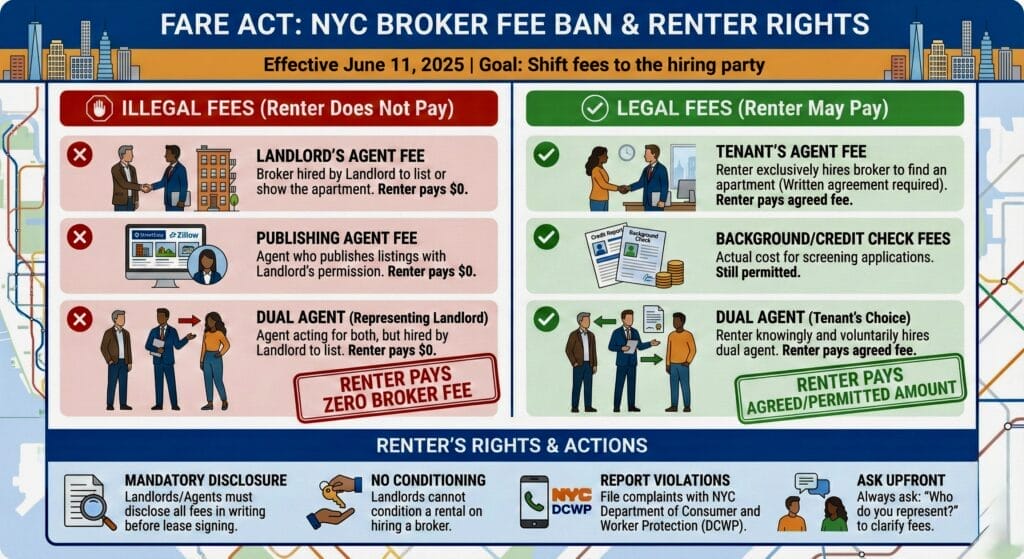

What the FARE Act Actually Prohibits

The Fairness in Apartment Rental Expenses (FARE) Act establishes one core principle: whoever hires the broker pays the broker. When a landlord or property manager hires a broker to market and show an apartment, that landlord pays the broker’s fee – not you.

Fees That Are Now Illegal

- Broker fees for landlord-hired agents: If a broker lists an apartment on StreetEasy, Zillow, or any platform with the landlord’s permission, that broker works for the landlord. You cannot be charged their fee.

- Dual-agent fee demands: Landlords cannot require you to use a specific broker or dual agent who represents both parties, then charge you for that broker.

- Conditional rental agreements: No one can condition your ability to rent an apartment on paying a broker fee to someone you did not hire.

- Tenant broker claims on listings: A broker who publishes a listing is legally presumed to work for the landlord. Relabeling themselves as a tenant broker on that same listing violates the law.

Fees That Remain Legal

- Credit and background check fees: Capped at $20 total under New York State law (Housing Stability and Tenant Protection Act of 2019). Landlords must provide you a copy of the report.

- Tenant-hired broker fees: If you independently hire a broker to help you search for apartments, you pay their fee. The key: you initiated the relationship, not the landlord.

- Security deposits: Limited to one month’s rent under New York law.

How the FARE Act Is Playing Out in Brooklyn and Staten Island

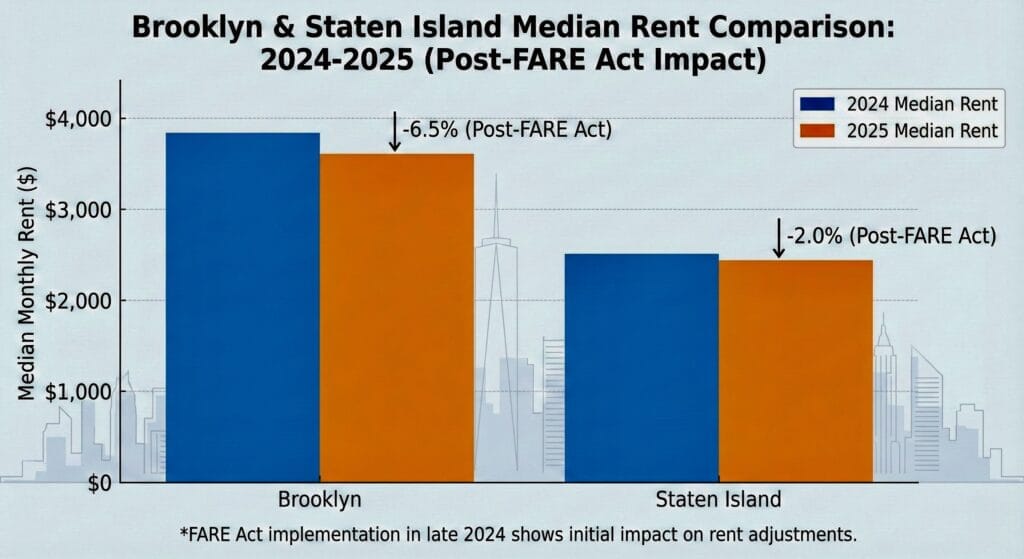

Six months after implementation, market data reveals distinct patterns across NYC’s outer boroughs – and some trade-offs renters should understand.

Staten Island: Highest Rent Growth in the City

Staten Island’s median rent grew 16.4% year-over-year as of October 2025, reaching $3,200 per month – the steepest increase among all five boroughs. While citywide median rent rose 8.2%, Staten Island’s smaller rental inventory and higher concentration of single-landlord properties appear to magnify price adjustments.

The bottom line: Even with higher monthly rents, eliminating the broker fee saves most Staten Island renters money over a typical lease term. If you’re a renter considering the jump to homeownership, our first-time homebuyer guide for Staten Island breaks down the numbers. A 15% broker fee on a $3,200 apartment equals $5,760 upfront. Spreading a 10% rent increase across 12 months adds roughly $320/month – which takes 18+ months to equal the eliminated fee.

Brooklyn: More Inventory, More Competition

Brooklyn saw modest inventory growth (up 1.9% year-over-year in some reports), but competition remains fierce. Nearly 32% of Brooklyn tenants ended up in bidding wars during summer 2025. Neighborhoods like Gravesend offer more inventory and less competition than north Brooklyn hotspots. Average rent in Brooklyn reached $4,340 in October 2025, with the median at $3,850 – an 8.5% and 6.9% increase respectively.

Two-bedroom apartments saw the steepest increases, with median rents up 13.3% to $4,250. For renters watching their budget, this makes early-stage apartment hunting and prompt applications more critical than ever. Our guide to affordable Brooklyn neighborhoods can help you identify areas where competition may be less intense.

| Real-World Math: Pre-FARE vs. Post-FARE Costs Example: $3,000/month Brooklyn apartment Before FARE Act: First month ($3,000) + Security ($3,000) + Broker fee ($5,400) = $11,400 upfront After FARE Act: First month ($3,000) + Security ($3,000) = $6,000 upfront Your savings: $5,400 (plus avoided gross-up tax implications) |

5 Red Flags: How to Spot Illegal Broker Fee Workarounds

Since the FARE Act took effect, some landlords and brokers have attempted creative workarounds. The NYC Department of Consumer and Worker Protection (DCWP) received over 1,125 complaints in the first several months. Here are the most common violations to watch for:

1. Management Fees or Technology Fees

Some listings have introduced new fees labeled as management, administrative, or technology fees totaling up to $4,200. One way to sidestep these workarounds entirely is to find private landlords in Staten Island who rent directly without brokers. If these fees did not exist before FARE and appeared suspiciously close to old broker fee amounts, they are likely being challenged as illegal workarounds.

2. Application Fees Over $20

New York State law caps credit and background check fees at $20 total. Any application fee significantly higher than this – especially if it resembles a broker fee percentage – is a red flag.

3. Tenant Broker Relabeling

A broker who publishes a listing with the landlord’s permission is legally presumed to represent the landlord. Claiming to be a tenant broker while listing that same unit violates FARE. If you found the apartment through a public listing, the broker works for the landlord – period.

4. Mandatory Move-In Services

Watch for vague move-in coordination or leasing services charges that cost hundreds of dollars for basic tasks. Any fee not clearly disclosed upfront in the listing may violate disclosure requirements.

5. Pressure to Sign Before Disclosure

The FARE Act requires landlords to provide a signed, itemized written disclosure of ALL fees before you sign a lease. Rushing you to sign without this disclosure is itself a violation.

What to Do If Someone Tries to Charge You an Illegal Fee

You have more power than you think. Council Member Chi Osse, who sponsored the FARE Act, has encouraged renters to screenshot, snitch, report and become a community enforcer.

Step 1: Document Everything

Before anything else, preserve evidence. The DCWP needs specific documentation to build actionable cases:

- Screenshot the listing (capture the full URL and date)

- Save all text messages and emails with the broker or landlord

- Keep any written fee disclosures (or note their absence)

- Record the broker’s name, brokerage, phone number, and email

- Note which websites carried the listing

Step 2: File a Complaint with DCWP

The NYC Department of Consumer and Worker Protection enforces the FARE Act and can issue fines from $750 (first offense) to $2,000 (repeat violations). They can also require restitution – getting your money back if you already paid.

Two ways to file:

- Online: Visit nyc.gov/consumers (no account required)

- By phone: Call 311

Important: You do not have to be actively renting to file. Even spotting a suspicious online listing is enough to report it.

Step 3: Report to the Listing Platform

StreetEasy and other platforms have implemented FARE Act compliance features. Use the Report function on suspicious listings. However, always file with DCWP first – they are the enforcement agency with fining authority.

Step 4: Consider Private Legal Action

The FARE Act creates a private cause of action, meaning you can sue in civil court to recover illegally charged fees. Note: if you pursue private litigation, you cannot also receive restitution through an active DCWP complaint for the same violation.

Your FARE Act Compliance Checklist

Use this checklist before signing any NYC lease:

- Did the landlord or agent provide a signed, itemized fee disclosure?

- Is the listing broker-represented? If yes, the landlord pays – not you

- Are credit/background check fees $20 or less combined?

- Have you asked for written confirmation of all move-in costs?

- Are there any unexplained administrative or technology fees?

- Have you screenshotted the listing and all communications?

- Is the security deposit one month’s rent or less?

Frequently Asked Questions

Does the FARE Act apply to Staten Island and Brooklyn?

Yes. The FARE Act covers all five NYC boroughs: Manhattan, Brooklyn, Queens, the Bronx, and Staten Island. It applies to any residential rental where the broker was hired by the landlord.

What if I signed a lease before June 11, 2025?

If you had a contractual obligation to pay a broker fee that arose before June 11, 2025, different rules may apply depending on your circumstances. However, no new broker fees can be charged after that date for landlord-hired brokers.

Can I still hire my own broker?

Absolutely. If you want specialized help finding apartments or negotiating lease terms, you can hire a tenant’s broker and pay their fee. The key difference: you initiated the relationship, and the fee arrangement is between you and your broker – not imposed by the landlord.

What if the broker says they are a tenant’s broker on the listing?

This is a violation. To list an apartment on platforms like StreetEasy or Zillow, a broker needs the landlord’s permission. That permission makes them the landlord’s agent. Relabeling does not change the legal reality – report it to DCWP.

Will rents just go up to cover the broker fee?

Market data shows rent increases have occurred but not uniformly across all properties. StreetEasy analysis found that rent increases in no-fee listings averaged about 5.3%, suggesting landlords are absorbing much of the cost. Even with moderate rent increases, most renters still save money by not paying a lump-sum broker fee upfront.

How long does a DCWP complaint take?

DCWP has a dedicated team investigating FARE Act violations. Investigations take time, and many complaints require additional documentation. Be prepared to respond promptly if DCWP contacts you for more information. The agency has issued summonses and won cases, but do not expect instant refunds.

Official Resources

- DCWP FARE Act FAQ: nyc.gov/site/dca/about/FAQ-Broker-Fees.page

- File a DCWP Complaint: nyc.gov/consumers or call 311

- Council Member Chi Osse’s Office: 718-919-0740 | district36@council.nyc.gov

- Renter Rights Brochure (11 languages): Available on DCWP website

| Ready to Find Your Brooklyn or Staten Island Home? Robert DeFalco Realty has served NYC renters and buyers for decades. We stay on top of changing regulations so you do not have to. Whether you are apartment hunting in Bay Ridge, searching for a two-family in Tottenville, or exploring first-time buyer programs in New York and New Jersey, our team is here to help. Browse Staten Island Rentals | Contact Our Team |

Disclaimer: This article provides general information about NYC’s FARE Act and is not legal advice. Laws and enforcement may change. For specific legal questions about your situation, consult a qualified real estate attorney.