Introduction: The Rate Reality Facing NY & NJ Homebuyers

If you’ve been tracking mortgage rates this fall hoping the Federal Reserve’s rate cuts would deliver immediate relief, you’ve likely experienced some sticker shock. Despite the Fed lowering its benchmark rate by 75 basis points since September, 30-year fixed mortgage rates are hovering stubbornly between 6.22% and 6.44% as of mid-November 2025—barely budging from their summer highs.

For families eyeing homes in Staten Island, Hudson County, or Monmouth County, this disconnect raises urgent questions: Why aren’t mortgage rates falling in sync with Fed cuts? How are tariff concerns complicating the picture? And most importantly—should you buy now or wait?

This guide breaks down the real-world forces behind today’s mortgage rate environment, with honest assessments tailored to the tri-state area’s unique affordability landscape. You’ll learn why the bond market matters more than Fed announcements, how potential tariff policies could ripple into home prices and renovation costs, and what the math actually looks like for buyers in your specific county.

No sugarcoating—just clear information to help you make the smartest move for your family and finances.

Federal Reserve Rate Cuts vs. Mortgage Rate Trends

Fed Policy Actions

The Federal Reserve implemented two consecutive rate cuts totaling 0.50%:

- September 17: First 0.25% cut (to 4.25-4.50%)

- October 29: Second 0.25% cut (to 4.00-4.25%)

Despite these cuts, mortgage rates trended upward due to other economic factors.

Tariff Impact

Trade policy has become the dominant factor in mortgage rate determination:

- $350 billion in expected tariff revenues created inflation concerns

- Bond market volatility increased yields on mortgage-backed securities

- Trade uncertainty created a rate floor above 6%

Market Implications

This divergence represents a fundamental shift from previous rate cycles:

- Fed cuts no longer guarantee lower mortgage rates

- Traditional rate timing strategies are less reliable

- Trade policy has become the primary rate driver

Key Events Timeline

Why Fed Rate Cuts Don’t Automatically Lower Mortgage Rates

The Federal Reserve’s benchmark rate and your mortgage rate aren’t the same thing—and understanding this distinction is essential to making sense of today’s market.

The Bond Market Connection—What Really Drives Mortgage Rates

Mortgage rates move in tandem with the 10-year Treasury yield, not the Federal Reserve’s overnight lending rate. Here’s why: when you take out a mortgage, your lender packages that loan with thousands of others into mortgage-backed securities (MBS) that get sold to investors. Those investors demand yields competitive with other bonds—especially the 10-year Treasury, which is considered the safest investment in the world.

When Treasury yields rise, mortgage rates rise. When Treasury yields fall, mortgage rates can fall—but only if investors believe inflation is under control and the economy is stable.

Right now, the 10-year Treasury yield is hovering around 4.4%–4.5%, significantly higher than where it sat during the Fed’s previous rate-cutting cycles. Why? Investors are worried about persistent inflation, ongoing government deficits, and the potential for tariff-driven price increases. These concerns keep bond yields elevated, which in turn keeps mortgage rates elevated.

Inflation Expectations and Investor Behavior

The Fed can cut its overnight rate all it wants, but if bond investors believe inflation will stay above the Fed’s 2% target, they’ll demand higher yields to compensate for the erosion of purchasing power. Recent economic data—including sticky wage growth, resilient consumer spending, and tariff uncertainty—has kept inflation expectations elevated.

Add to this the fact that the Fed has been reducing its holdings of mortgage-backed securities (a process called quantitative tightening), and you have less demand for MBS in the market, which pushes mortgage rates higher even as the Fed cuts its benchmark rate.

Bottom line: mortgage rates respond to long-term inflation expectations and bond market sentiment, not short-term Fed policy moves. This is why rate cuts haven’t delivered the relief many homebuyers expected.

How Tariffs Enter the Housing Equation

Tariff policy discussions throughout 2024 and into 2025 have introduced a new layer of uncertainty into the housing market. While tariffs on imports don’t directly affect mortgage rates, they influence home prices, construction costs, and renovation budgets—all of which shape the true affordability picture for buyers.

Direct Impact—Construction Material and Appliance Costs

Tariffs on imported lumber, steel, aluminum, and finished goods like appliances and fixtures create a ripple effect across the housing market. According to industry estimates, tariffs implemented or proposed in recent years have added roughly $3,000–$9,000 to the cost of building a new single-family home, depending on the project’s scope and materials sourcing.

For buyers in the NY/NJ market, this means:

- New construction homes may carry premium pricing as builders pass along material cost increases and hedge against future tariff uncertainty.

- Imported appliances and fixtures (refrigerators, HVAC systems, flooring, cabinetry) cost more, which affects both new builds and renovation budgets.

- Resale homes with older mechanicals or deferred maintenance become less attractive if buyers anticipate expensive replacements at tariff-inflated prices.

Indirect Impact—Builder Pricing and Inventory Delays

Beyond direct material costs, tariffs create uncertainty that slows construction timelines and constrains inventory. Builders who can’t reliably forecast material costs either delay projects or price homes conservatively to protect margins. This can exacerbate already-tight inventory in desirable markets like Monmouth County and Hudson County, where demand consistently outpaces supply.

In markets where new construction makes up a meaningful share of available inventory, fewer projects coming to market means heightened competition for existing homes—and upward pressure on prices.

Renovation and Fix-Up Costs for Existing Homes

For buyers considering fixer-uppers or homes that need updates, tariffs hit especially hard. Renovating a kitchen or bathroom, replacing a roof, or upgrading HVAC systems all require materials and appliances subject to tariff-related cost increases.

A typical Staten Island two-family home renovation—say, updating both kitchens and replacing the heating system—could cost $5,000–$12,000 more in a tariff-affected environment than it would have a few years ago. For families already stretching to afford entry-level homes in Staten Island, these hidden costs matter.

Practical takeaway: if you’re eyeing a home that needs work, get contractor estimates early and factor tariff-inflated material costs into your budget. What looks like a bargain purchase price can become a money pit if renovation costs spiral.

The Current Rate Environment—November 2025 Snapshot

Let’s look at what mortgage rates actually look like right now for buyers in the New York and New Jersey markets.

National Rate Averages vs. NY/NJ Local Rates

As of mid-November 2025, the national average for a 30-year fixed-rate mortgage sits at approximately 6.22% for borrowers with excellent credit (740+ FICO scores) and 20% down payments. In the NY/NJ market, rates are slightly higher due to higher home prices, property taxes, and regional risk factors—typically adding 10–25 basis points.

Here’s the breakdown by loan type:

| Loan Type | National Average | NY/NJ Range |

|---|---|---|

| 30-Year Fixed | 6.22% | 6.30%–6.44% |

| 15-Year Fixed | 5.48% | 5.55%–5.70% |

| 5/1 ARM | 5.75% | 5.85%–6.00% |

| FHA (3.5% down) | 6.10% | 6.20%–6.35% |

| Jumbo (>$806,500) | 6.45% | 6.55%–6.75% |

Rate Spread by Loan Type and Credit Profile

Your actual rate depends heavily on your credit score, down payment, and loan-to-value ratio. Here’s how a 20-basis-point difference in rate translates to real dollars on a $500,000 home with 10% down:

- 6.20% rate: $2,760/month (principal + interest)

- 6.40% rate: $2,822/month (principal + interest)

- Difference: $62/month, or $744/year

Over 30 years, that 0.20% rate difference costs you an additional $22,320 in interest. This is why working with an experienced mortgage professional who can shop rates across multiple lenders matters—especially in markets where every dollar counts.

Credit score impact is equally significant. A buyer with a 680 FICO score might pay 0.50%–0.75% more than a buyer with a 760 score, translating to an extra $150–$250/month on a typical tri-state area home.

Action step: Before you start house hunting, get pre-approved with multiple lenders and understand exactly where your credit score and down payment put you in the rate spectrum. Use our mortgage calculator to stress-test different scenarios.

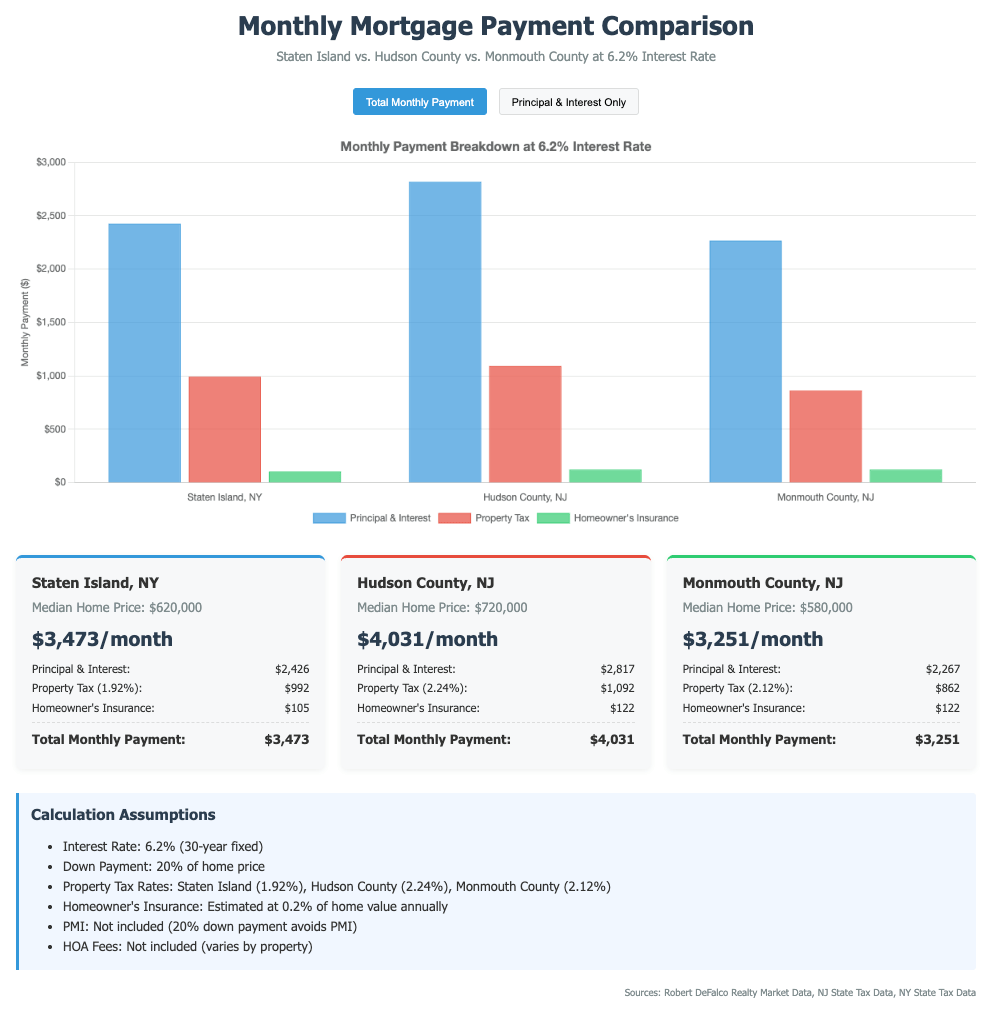

Local Market Analysis: Staten Island, Hudson County, Monmouth County

Mortgage rates matter, but they matter differently depending on where you’re buying and what you’re buying. Let’s break down how today’s rate environment plays out in three key NY/NJ markets.

Staten Island—Affordability at 6.2% vs. Waiting for 5.5%

Staten Island remains one of the most affordable entry points for families who want single-family homeownership within New York City limits. The median home price in Staten Island currently sits around $650,000–$700,000, depending on neighborhood.

Real payment example (median $675,000 home, 10% down, 6.3% rate):

- Monthly payment (P&I): $3,770

- Property taxes (est.): $1,000

- Insurance: $200

- Total monthly: ~$4,970

If you wait for rates to drop to 5.5%—which may or may not happen in 2025—your payment drops to about $3,440 (P&I), or $4,640 total. That’s a $330/month savings.

But here’s the trade-off: if home prices appreciate even 3% while you wait (a conservative estimate given Staten Island’s inventory constraints), that same home now costs $695,250. At 5.5%, your monthly payment is $4,700—higher than buying today at 6.3%.

This math explains why many Staten Island buyers are acting now rather than gambling on a perfect rate environment that may never arrive.

Hudson County—Inventory Constraints and Rate Sensitivity

Hudson County—especially Hoboken, Jersey City, and Weehawken—faces the tightest inventory in the region. Median condo prices hover around $500,000–$650,000, with single-family homes starting north of $700,000.

At these price points, rate sensitivity is acute. On a $600,000 condo with 15% down:

- 6.4% rate: $3,200/month (P&I)

- 5.5% rate: $2,895/month (P&I)

- Difference: $305/month

For buyers in competitive Hudson County markets, losing a bidding war while waiting for lower rates could mean missing the opportunity entirely. Available units in desirable buildings often see multiple offers within days, and sellers have little incentive to negotiate when inventory remains constrained.

Strategic insight: if you find the right property in Jersey City or Hoboken, acting on it now—even at 6.3%–6.4%—may be smarter than waiting and facing both higher prices and continued competition.

Monmouth County—Suburban Demand and Rate Impact

Monmouth County appeals to families seeking more space, good schools, and reasonable commutes to Manhattan or North Jersey job centers. Towns like Red Bank, Middletown, and Holmdel offer single-family homes in the $550,000–$850,000 range.

At current rates, a $700,000 home with 15% down costs roughly $3,700/month (P&I). If rates fall to 5.5%, that drops to $3,350/month—a $350 monthly savings.

However, Monmouth County has seen consistent 4%–5% annual appreciation over the past three years, driven by remote work flexibility and NYC transplants. Waiting six months for a potential rate drop could mean facing a $735,000 price tag on that same home, which at 5.5% brings your payment right back to $3,520/month—negating much of the rate benefit.

For Monmouth buyers: prioritize finding the right home in the right school district over timing the rate market perfectly. You can refinance later if rates improve, but you can’t recapture a lost opportunity on a home that checks all your boxes.

Should You Buy Now or Wait? A Decision Framework

This is the question on every buyer’s mind, and the honest answer is: it depends on your specific circumstances. Here’s how to think through the decision.

The Math—When Waiting Costs More Than Acting

Let’s run a break-even scenario. Assume you’re looking at a $650,000 home with 10% down:

Scenario A: Buy now at 6.3%

- Loan amount: $585,000

- Monthly P&I: $3,630

- Year 1 total payments: $43,560

Scenario B: Wait 12 months for rates to hit 5.5%

- If home price appreciates 4%: $676,000

- Loan amount: $608,400

- Monthly P&I: $3,450

- Year 1 total payments: $41,400

You save $2,160 in Year 1 payments by waiting—but you’ve also missed 12 months of building equity, paid 12 months of rent (assume $2,500/month = $30,000), and now need an extra $26,000 for your down payment.

Net result: waiting costs you roughly $53,840 ($30,000 rent + $26,000 additional down payment – $2,160 payment savings). You’re significantly behind even if rates improve.

This math doesn’t work out the same for everyone—your rent costs, down payment readiness, and local appreciation rates all matter—but it illustrates why “waiting for perfect rates” often backfires.

Scenarios Where Waiting Makes Sense

There are legitimate reasons to hold off:

- Your financial foundation isn’t solid yet: If you don’t have a stable emergency fund (6 months’ expenses) or your debt-to-income ratio is pushing the limit, waiting to strengthen your finances is smart.

- You’re in a rapidly cooling market: Some submarkets (luxury condos in certain buildings, overbuilt new construction clusters) are seeing price reductions. If you’re targeting one of these niches, patience could pay off.

- Major life changes are imminent: If there’s a reasonable chance you’ll relocate for work or family reasons within 2–3 years, the transaction costs of buying and selling make renting a safer bet.

- You’re holding out for a specific property or neighborhood: Sometimes the right home just isn’t available yet. If you can wait comfortably without financial strain, being selective pays long-term dividends.

The Refinance Option—Your Safety Net

Here’s the safety net that makes buying now less risky: you can refinance later if rates drop meaningfully.

Let’s say you buy today at 6.3% and rates fall to 5.0% in 24 months. Refinancing that $585,000 loan saves you roughly $450/month, or $5,400/year. Even after paying closing costs of $4,000–$6,000, you recoup your investment within 12–18 months and save tens of thousands over the life of the loan.

This is why experienced buyers don’t wait for perfect rates—they marry the house and date the rate. The right home in the right location at a fair price is the priority. The rate is just a variable you can change later.

Practical advice: if you’re leaning toward buying now, ask your lender to project refinance break-even timelines at various rate scenarios (5.5%, 5.0%, 4.75%). This helps you model your downside protection and makes the decision less emotional.

For more guidance on evaluating home affordability, check out our comprehensive guide to buying your first home in Staten Island.

Strategies for Managing Higher Rates in Today’s Market

If you’re moving forward with a purchase in the current rate environment, here are tactical strategies to reduce your borrowing costs and improve your monthly cash flow.

Consider Adjustable-Rate Mortgages (ARMs)—When They Make Sense

Adjustable-rate mortgages typically offer lower initial rates than 30-year fixed loans—often 50–75 basis points lower. A 5/1 ARM (fixed for five years, then adjusts annually) or 7/1 ARM (fixed for seven years) can make sense if:

- You plan to sell or refinance within the fixed-rate period

- You expect rates to decline over the next few years

- You want to maximize purchasing power today while maintaining flexibility

Current 5/1 ARM rates in the NY/NJ market are around 5.85%–6.00%, compared to 6.30%–6.44% for 30-year fixed loans. On a $600,000 loan, that’s a $180–$220/month savings during the fixed period.

Risk consideration: if you’re still in the home when the ARM adjusts and rates haven’t fallen, your payment could increase. Make sure you can afford potential rate increases or have a clear exit strategy (sale or refinance) before the adjustment period begins.

Buying Down Your Rate with Discount Points

Paying discount points upfront—essentially prepaid interest—can reduce your mortgage rate permanently. One point typically costs 1% of your loan amount and lowers your rate by 0.25%.

Example math ($600,000 loan):

- Pay 2 points ($12,000) to reduce rate from 6.30% to 5.80%

- Monthly savings: ~$180

- Break-even timeline: 67 months (5.5 years)

If you plan to stay in the home longer than the break-even period, buying points saves money. If you might sell or refinance sooner, you won’t recoup the upfront cost.

Best for: buyers with extra cash who plan to stay put long-term and want to lock in a lower rate permanently.

Alternative Loan Products (FHA, Conventional with Lower Down Payment)

If your down payment is limited, consider these options:

- FHA loans: 3.5% down, slightly lower rates than conventional for buyers with good credit, though you’ll pay mortgage insurance premiums (MIP) for the life of the loan.

- Conventional 97 loans: 3% down for first-time buyers with strong credit; PMI drops off once you reach 20% equity.

- NY/NJ first-time buyer programs: Some municipalities and nonprofits offer down payment assistance grants or reduced-rate mortgages. Programs vary by county and income level.

Lower down payment loans mean higher monthly payments (larger loan balance + mortgage insurance), but they get you into homeownership sooner—allowing you to start building equity and benefiting from appreciation.

For Staten Island buyers specifically, explore first-time homebuyer grants available on Staten Island to see if you qualify for assistance.

Timing Your Rate Lock

Once you’re under contract, you’ll need to lock your rate. Most lenders offer locks for 30, 45, or 60 days. Longer locks cost more, but they protect you if rates rise during your closing timeline.

Pro tip: if you expect rates to fall, consider a “float-down” option that lets you lock in a lower rate if market conditions improve before closing—though this typically costs extra upfront.

Work closely with your loan officer to time your lock strategically based on Fed meeting schedules, economic data releases, and your closing timeline.

What to Watch in 2025—Rate Outlook and Economic Signals

While no one can predict mortgage rates with certainty, these indicators will shape the rate environment over the coming months.

Fed Meeting Schedule and Expected Policy Trajectory

The Federal Reserve has three more scheduled meetings before year-end 2025. Current market expectations suggest one additional 25-basis-point rate cut in December, with the possibility of holding rates steady in early 2026 depending on inflation data.

However, Fed cuts don’t automatically mean lower mortgage rates—as we’ve seen throughout 2024 and into 2025. The bond market will respond more to inflation trends and Treasury supply dynamics than to Fed policy.

Key Economic Indicators to Monitor

Watch these data points to gauge where rates might head:

- Consumer Price Index (CPI): Monthly inflation readings, especially core CPI (excluding food and energy), drive bond market sentiment.

- Jobs reports: Strong employment numbers can keep rates elevated by signaling continued economic strength and potential inflation pressure.

- 10-year Treasury yield: This is your real-time mortgage rate proxy. When Treasury yields spike, mortgage rates follow within days.

- Mortgage application volume: Sharp declines in refinance and purchase applications often precede rate drops as lenders compete for business.

Tariff Policy Developments and Trade Negotiations

Any major announcements on tariff implementations, trade negotiations, or policy reversals will impact construction costs and builder confidence. Watch for:

- Proposed tariff rates on lumber, steel, and building materials from key trading partners

- Homebuilder sentiment surveys (National Association of Home Builders)

- Material cost indices (Producer Price Index for construction materials)

Tariff escalation could drive home prices higher even if mortgage rates moderate, negating affordability gains. Conversely, tariff rollbacks could ease material costs and improve inventory flow.

Expert Consensus Range for 2025 Rates

Most housing economists and mortgage industry analysts project 30-year fixed rates will remain in the 5.75%–6.50% range through the end of 2025, with the potential for dipping below 6% if inflation cools significantly. Rates below 5.5% appear unlikely absent a major economic disruption.

Bottom line: expect gradual improvement but not a dramatic return to pandemic-era 3%–4% rates. Plan accordingly.

Frequently Asked Questions

Why are mortgage rates still high if the Fed cut rates?

Mortgage rates track the 10-year Treasury yield, not the Federal Reserve’s overnight rate. Treasury yields remain elevated due to inflation concerns, government deficit spending, and reduced Fed demand for mortgage-backed securities. Until long-term inflation expectations moderate and bond market sentiment improves, mortgage rates will stay elevated regardless of Fed cuts.

Will tariffs make homes more expensive in 2025?

Tariffs on imported construction materials increase costs for builders, which typically get passed on to buyers through higher prices on new construction homes. Existing home renovations also cost more due to tariff-affected appliances and materials. The impact varies by project scope, but industry estimates suggest tariffs add $3,000–$9,000 to typical new home construction costs.

What’s a good mortgage rate right now in New Jersey?

For well-qualified buyers (740+ credit score, 20% down), a “good” rate in New Jersey as of November 2025 is around 6.20%–6.35% for a 30-year fixed mortgage. Rates vary by lender, loan type, and specific property location. Shopping multiple lenders and comparing total costs—not just rates—is essential. Check current rates across different New Jersey communities.

Should I wait for rates to drop to 5%?

Waiting for a specific rate target is risky because home prices may appreciate faster than rate declines save you money. Run the math: if a home appreciates 4% while you wait for rates to drop 0.75%, you often end up with higher monthly payments despite the lower rate. Additionally, you’ll pay rent while waiting and potentially face more competition when you do buy. Focus on affordability and the right property over perfect rate timing.

Can I refinance later if rates drop?

Yes. Refinancing is straightforward if rates decline meaningfully after your purchase. Most buyers recoup refinance closing costs ($4,000–$6,000) within 12–24 months if they secure a rate at least 0.75%–1.00% lower than their original rate. This is why experienced buyers prioritize finding the right home over waiting for perfect rates—you can always refinance the rate, but you can’t reclaim a missed opportunity on the right property.

How much does a 1% rate difference cost monthly?

On a $600,000 loan, a 1% rate difference (e.g., 6.30% vs. 5.30%) costs approximately $360/month in principal and interest—or $4,320/year. Over 30 years, that’s roughly $129,600 in additional interest. However, the actual monthly impact depends on your loan amount, so use a mortgage calculator to model your specific scenario.

Conclusion: Smart Buying Starts with Clear Information

Mortgage rates at 6.2%–6.4% aren’t ideal, but they’re far from prohibitive—especially in a market where home prices continue to appreciate and inventory remains constrained. The disconnect between Fed rate cuts and mortgage rates reflects bond market realities that aren’t changing overnight, and tariff uncertainty adds another layer of complexity to the affordability equation.

For buyers in Staten Island, Hudson County, and Monmouth County, the decision comes down to this: are you better off acting on the right property today at 6.3%, or gambling that rates will drop enough to offset probable price appreciation and another year of rent?

The math usually favors action, especially if you have a clear refinance strategy for when rates do improve. You don’t need perfect conditions—you need the right home, solid financing, and a realistic understanding of the trade-offs.

Ready to explore what’s possible at today’s rates? Browse current listings in Staten Island, Hudson County, and Monmouth County—or reach out to Robert DeFalco Realty to run the numbers on a home you love.