Seller concessions have become a strategic negotiating tool in Staten Island’s evolving real estate market. With inventory rising 11.4% and 73% of homes selling below asking price, offering to cover a portion of the buyer’s closing costs can mean the difference between a stalled listing and a successful sale.

But seller concessions aren’t a one-size-fits-all solution. The financial impact varies based on loan type, market conditions, and your specific situation. This guide breaks down exactly how concessions work in New York, what limits apply, and when they make sense for Staten Island sellers navigating today’s market.

What Are Seller Concessions?

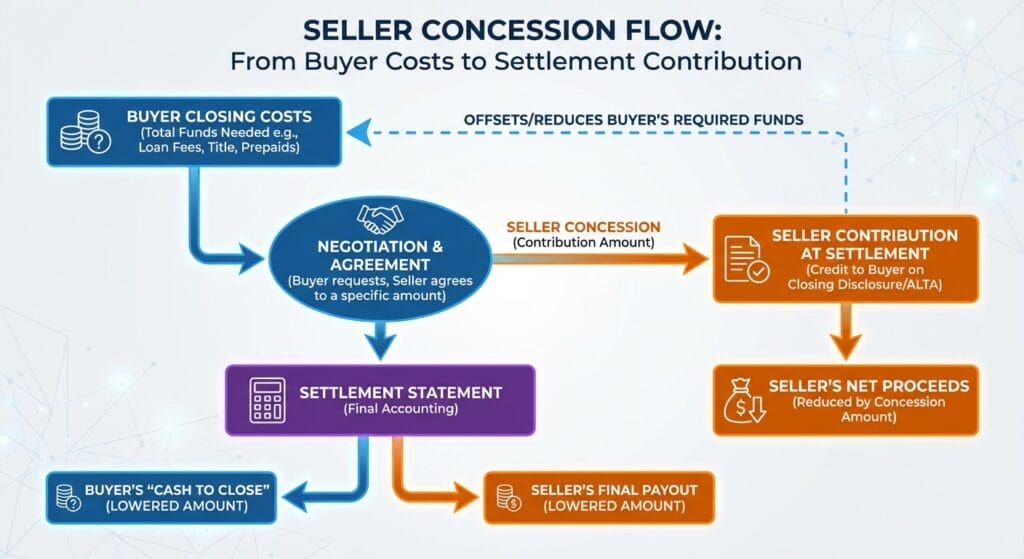

Seller concessions are credits or payments a home seller agrees to make toward the buyer’s transaction costs. Rather than reducing your asking price, concessions allow you to contribute a specific dollar amount or percentage toward expenses the buyer would otherwise pay out of pocket.

Here’s a practical example: Your home sells for $700,000 with a $21,000 seller concession (3%). The buyer finances $679,000 and uses your $21,000 contribution to cover their closing costs. You net $679,000 after the concession—functionally equivalent to a price reduction, but structured differently on the settlement statement.

Common Misconceptions About Concessions

Many Staten Island sellers confuse concessions with simple price cuts. The key distinction: concessions are applied specifically to buyer costs at closing, not deducted from the purchase price for tax calculations. While the net effect on your proceeds is similar, the contractual structure differs—and that matters for financing, appraisals, and negotiations.

Concessions also differ from repairs. Rather than fixing a roof or updating systems before closing, you provide funds the buyer uses after taking ownership. This approach speeds the transaction while giving buyers flexibility to address issues on their timeline.

Why Offer Concessions in 2025?

Staten Island’s current market presents specific conditions where concessions make strategic sense. Median home prices reached $730,000–$750,000, putting significant cash requirements on buyers already facing elevated interest rates. Many qualified purchasers have strong income and credit but limited reserves for closing costs after their down payment.

For sellers, concessions serve as an alternative to price reductions when inventory increases and buyer demand softens. Rather than broadcasting a lower listing price—which can trigger appraisal concerns and signal desperation—concessions maintain your asking price while making the deal financially viable for buyers.

Types of Seller Concessions in New York

Closing Cost Credits (Most Common)

Closing cost credits represent the vast majority of seller concessions in Staten Island transactions. These credits offset specific expenses buyers incur when securing financing and transferring title:

Buyer’s attorney fees ($2,000–$4,000): Legal representation for contract review, title examination, and closing attendance. In New York, both parties typically hire separate attorneys—unlike many states where a single attorney or title company handles the transaction.

Title insurance ($2,000–$4,000 for $700,000 purchase): Protects the buyer’s lender against title defects. Rates in New York are regulated but vary by county and insurer.

Transfer taxes: New York State transfer tax (0.4%) plus NYC transfer tax (1.425% for properties over $500,000) typically fall on sellers, but concessions can cover the buyer’s share of associated recording fees and mortgage tax.

Loan origination fees (0.5%–1% of loan amount): Lender charges for processing and underwriting the mortgage. These can run $3,500–$7,000 on a $700,000 loan.

Appraisal and inspection fees ($500–$1,500 combined): Third-party property evaluations required by lenders and prudent buyers.

Repair Credits

Inspection reports inevitably reveal maintenance items—aging HVAC systems, roof repairs, outdated electrical work. Rather than making repairs pre-closing, you can offer a credit reflecting the estimated cost. The buyer then addresses these issues after closing on their schedule and with their chosen contractors.

Repair credits particularly benefit sellers who’ve already relocated or lack time to manage contractors. Wonder whether repairs or credits make more sense? If the estimated repair cost is $5,000 but you’d need two weeks to coordinate work, a $4,000 credit that closes the deal immediately might be your best option. For more guidance on seller disclosure requirements, consult with your attorney and agent.

Rate Buydowns

Rate buydowns have surged in popularity during the elevated rate environment of 2024–2025. You pay upfront discount points to reduce the buyer’s mortgage rate, lowering their monthly payment for a set period or permanently.

2-1 Buydown: The most common temporary structure. You pay approximately 2%–3% of the loan amount to reduce the buyer’s rate by 2 percentage points in year one and 1 point in year two, before reverting to the note rate in year three. A $560,000 loan might require $14,000–$16,800 from you to drop the buyer’s effective rate from 7% to 5% in year one.

Permanent Buydown: You pay approximately 1% per 0.25% rate reduction for the life of the loan. Expect to pay $5,600–$7,000 per quarter-point reduction on a $700,000 purchase with 20% down.

Rate buydowns appeal to buyers who plan to hold the property long-term and want the lowest possible payment during the initial years. Given mortgage rate uncertainty in 2025, this concession type draws serious attention from qualified purchasers.

Home Warranty

A one-year home warranty ($400–$800) covers major systems and appliances against breakdown. While less common in Staten Island than closing cost credits, warranties provide buyers peace of mind—particularly first-time purchasers concerned about unexpected repair costs.

The relatively modest cost makes home warranties an easy concession to include in offers. For guidance on whether a warranty makes sense for your property, read our analysis of home warranty costs versus self-insurance.

Personal Property Inclusion

Sometimes the most effective concessions aren’t financial. Leaving behind high-end appliances, custom window treatments, outdoor furniture, or garage storage systems can tip negotiations in your favor—especially if you’d otherwise need to move or dispose of these items.

Personal property concessions work best when the included items genuinely enhance the buyer’s move-in experience. A $5,000 outdoor kitchen setup that would cost you $1,500 to relocate represents a win-win scenario: you avoid hassle and expense while the buyer gains immediate value.

Seller Concession Limits in New York

Federal lending guidelines cap seller concessions based on loan type and down payment. These limits aren’t suggestions—they’re hard ceilings enforced by underwriters. Exceed them, and the lender will reduce your contribution to the maximum allowed or reject the transaction entirely.

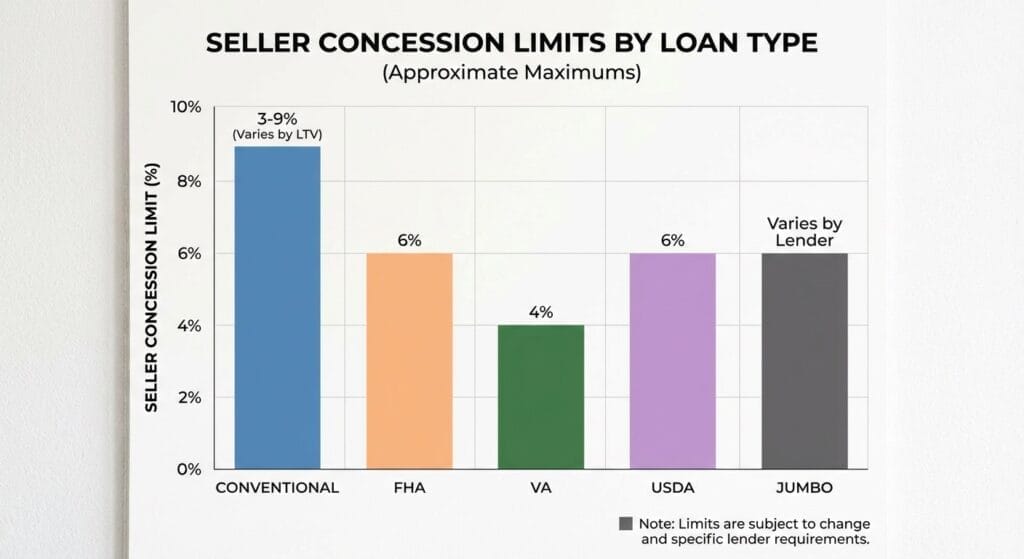

Conventional Loans

Fannie Mae and Freddie Mac tie concession limits to the buyer’s down payment:

Primary residence or second home:

- Less than 10% down: 3% maximum concession

- 10%–25% down: 6% maximum concession

- More than 25% down: 9% maximum concession

Investment property: 2% maximum regardless of down payment

For a $700,000 Staten Island home, these percentages translate to real dollars. A buyer putting 5% down ($35,000) can receive up to $21,000 in concessions. If they increase their down payment to 15% ($105,000), the concession ceiling rises to $42,000.

This tiered structure creates an interesting dynamic: buyers with larger down payments can negotiate more substantial concessions. For current conforming loan limits and Fannie Mae underwriting guidelines, lenders refer to official agency documentation throughout the approval process. If you’re facing competing offers, a buyer with 20% down requesting 5% in concessions might be more attractive than one with 5% down asking for the 3% maximum—despite the higher concession amount.

FHA Loans

Federal Housing Administration loans allow up to 6% in seller concessions regardless of down payment size. This uniform limit makes FHA transactions particularly attractive to sellers facing buyer requests for maximum concessions—you know exactly what you might be asked to contribute.

According to the U.S. Department of Housing and Urban Development, FHA’s 6% limit can cover virtually all buyer closing costs. On a $700,000 purchase, $42,000 in concessions more than covers typical closing costs of 2%–5% ($14,000–$35,000), potentially leaving room for rate buydowns or other incentives.

VA Loans

Department of Veterans Affairs loans feature unique concession structures. The VA allows sellers to pay all reasonable closing costs without limit—but restricts seller concessions to 4% of the purchase price for items beyond standard closing costs.

This distinction matters: covering the veteran buyer’s loan origination fee, appraisal, title insurance, and recording fees doesn’t count toward the 4% limit. The 4% cap applies to additional items like the VA funding fee, prepaid property taxes, HOA fees, or debt payoff. The Department of Veterans Affairs provides detailed guidance on what sellers can and cannot pay on behalf of veteran buyers.

For Staten Island sellers, VA buyers often bring the strongest financing despite lower down payment requirements (often 0%). The limited 4% concession cap, combined with the VA’s stringent appraisal standards, makes these transactions relatively straightforward compared to high-concession conventional deals.

USDA and Jumbo Loans

USDA rural development loans permit 6% seller concessions calculated on the loan amount (not purchase price)—though Staten Island properties rarely qualify for USDA financing given the borough’s urban classification.

Jumbo loans (those exceeding conforming limits, currently $806,500 for Staten Island) impose concession limits set by individual lenders, typically 2%–3% regardless of down payment. If you’re selling a higher-value property in Todt Hill or Great Kills, expect more restrictive concession negotiations.

Legal Limits vs. Lender Limits

New York State doesn’t impose its own seller concession caps beyond federal lending guidelines. However, lender overlays—additional restrictions individual banks impose—can further limit concessions. Some lenders cap contributions at 3% even when Fannie Mae would allow 6% for a given down payment.

Additionally, the concession amount cannot exceed the buyer’s actual closing costs. If your buyer’s costs total $18,000 and you’ve agreed to a $21,000 concession, the excess $3,000 cannot be refunded as cash to the buyer—it simply reduces your credit to $18,000. There’s no gaming the system for buyer cash back.

Pros and Cons for Staten Island Sellers

Advantages: When Concessions Work in Your Favor

Attract cash-constrained but qualified buyers. Many Staten Island purchasers have strong income and excellent credit but limited reserves after making their down payment. Offering 2%–3% in concessions ($14,000–$21,000 on a $700,000 home) expands your buyer pool to include these qualified purchasers who might otherwise skip your listing.

Close deals faster in a shifting market. When inventory rises and days on market extend, concessions can convert interested buyers into committed purchasers. Rather than waiting weeks for a buyer without concession needs, offering credits upfront accelerates your timeline—particularly valuable if you’ve already purchased your next home or face relocation deadlines.

Compete without visible price reductions. Lowering your listing price signals weakness and can trigger appraisal issues if comparable sales don’t support the new figure. Concessions maintain your asking price while effectively reducing the buyer’s total cash requirement. The psychological difference matters: buyers perceive “getting a credit” more positively than “settling for a reduced price.”

Avoid repair hassles and delays. Post-inspection negotiations often center on repair requests. Offering a credit instead of making actual repairs eliminates contractor coordination, permits, and closing delays while giving buyers control over the work. A $6,000 credit resolves the issue immediately; actually replacing that aging HVAC system might push closing back three weeks.

Disadvantages: When Concessions Backfire

Reduce your net proceeds directly. Every dollar in concessions comes straight out of your pocket. A $20,000 concession on your $700,000 sale reduces your net to $680,000 after commissions and closing costs—the same bottom line as accepting a $680,000 offer with no concessions. Make sure the strategic benefit justifies the cost.

May signal desperation or problems. Buyers and their agents read high concession offers as red flags. “Why is the seller willing to pay so much? What’s wrong with the house?” Offering 5%–6% concessions upfront can paradoxically reduce interest rather than increase it, particularly in competitive neighborhoods.

Create appraisal complications. Appraisers scrutinize purchase contracts and note concession amounts. If they believe you’ve inflated the purchase price to accommodate large concessions, they may adjust the appraised value downward. Result: the buyer’s lender requires a larger down payment or refuses the loan entirely, killing your deal despite your generous concession offer.

Complicate capital gains calculations. Seller concessions reduce your net proceeds and potentially affect capital gains tax liability. While concessions don’t change the nominal sale price for IRS reporting, they do reduce the cash you receive—impacting your ability to fund your next purchase or meet IRS safe harbor requirements for 1031 exchanges. Always consult your CPA before agreeing to substantial concessions.

When Concessions Make Strategic Sense

Your home has been on the market 45+ days. Average days on market currently sit at 86 days for Staten Island. If you’re approaching or exceeding this figure, buyer interest has likely stalled. Concessions—especially rate buydowns—can reignite attention without the stigma of a price cut.

Recent inspection revealed needed repairs. Buyers rarely walk away from minor issues, but they will negotiate hard. Offering a credit equal to 75%–100% of the estimated repair cost often closes the gap faster than haggling over contractor quotes and repair timelines.

You’re competing with new construction. Builders routinely offer rate buydowns, closing cost credits, and upgrades to move inventory. Resale homes compete more effectively by matching these incentives rather than simply lowering prices.

The buyer pool consists primarily of first-time purchasers. Neighborhoods attracting younger buyers—particularly areas with strong schools and reasonable commutes—see more concession requests. These buyers typically have less cash despite qualifying for mortgages. Adjust your expectations and budget accordingly.

You need to close quickly. Already purchased your next home? Facing job relocation? Paying two mortgages? A 3%–4% concession that guarantees closing in 45 days might cost less than carrying costs if your home sits unsold for three additional months.

How to Negotiate Seller Concessions

Typical Concession Requests in Staten Island

Current market conditions produce predictable concession patterns. FHA and VA buyers typically request 3%–6% in closing cost credits. Conventional buyers with 10%–15% down ask for 3%–4%. Buyers with 20%+ down rarely request concessions unless inspection issues arise or they’re stretching to purchase.

Rate buydown requests have increased substantially in 2025 as buyers seek relief from elevated mortgage rates. Expect requests for 2-1 buydowns costing 2%–3% of the loan amount, presented as alternatives to closing cost credits.

Counter-Offer Strategies That Protect Your Bottom Line

Split the difference on inspection repairs. Buyer requests $8,000 for roof repairs? Offer $5,000 and explain you’ve priced the home accounting for its condition. Many buyers accept reasonable counter-offers rather than resuming their search.

Cap concessions at actual closing costs. If the buyer requests 5% ($35,000) but you know their closing costs will be approximately $20,000, counter at 3% and make clear the concession will only cover actual documented costs. This prevents inflated requests.

Tie concessions to list price. “We’ll provide $15,000 in concessions but only at our full asking price of $710,000” keeps your gross proceeds at $695,000 while framing the concession as conditional. Buyers attempting to negotiate both price and concessions face a choice.

Offer non-cash alternatives. “We can’t provide closing cost credits, but we’ll leave the washer/dryer, refrigerator, and outdoor furniture” gives value without reducing your bottom line as severely.

Working Effectively With Your Agent

Your agent’s market knowledge directly impacts concession negotiations. An experienced Robert DeFalco Realty agent knows typical concession amounts for your neighborhood and price point, preventing you from either over-conceding or reflexively refusing reasonable requests.

Request a net proceeds analysis before agreeing to concessions. Your agent should show exactly what you’ll receive at closing after concessions, commissions, transfer taxes, and other costs. Sometimes the math reveals a simple price reduction yields better results than equivalent concessions.

Most importantly, decide your concession strategy before listing. Will you offer concessions proactively in your listing description? Set a maximum percentage you’ll consider? Refuse concessions unless inspection issues arise? Clear pre-listing direction prevents emotional decision-making during stressful negotiations.

Tax Implications of Seller Concessions

Seller concessions affect your tax liability in specific, often misunderstood ways. The IRS treats concessions as selling expenses that reduce your net proceeds—similar to real estate commissions or attorney fees.

Impact on capital gains. When calculating capital gains, you subtract your adjusted cost basis from the net selling price. Seller concessions reduce the net selling price, potentially lowering your taxable gain. For example:

- Gross sale price: $700,000

- Seller concessions: $20,000

- Real estate commissions: $42,000 (6%)

- Other closing costs: $5,000

- Net proceeds: $633,000

Your capital gain is calculated as $633,000 minus your adjusted cost basis, not $700,000 minus your basis. Concessions effectively lower your taxable gain by reducing what you actually received.

Reporting requirements. You don’t separately report concessions on your tax return. They appear as deductions on your settlement statement and reduce your total proceeds. Your closing attorney or title company will provide a HUD-1 or similar settlement statement showing all debits and credits, which you’ll use when preparing your return.

When concessions matter most for taxes. If your gain approaches the $250,000 (single) or $500,000 (married filing jointly) capital gains exclusion limit, concessions might push you under the threshold, eliminating tax liability entirely. Conversely, if you’re already above the exclusion limit, concessions reduce your taxable gain dollar-for-dollar in the 15%–20% capital gains tax brackets (plus 3.8% net investment income tax for high earners).

The complexity increases if you’re executing a 1031 exchange or have significant capital improvements to add to your cost basis. Large concessions might affect your ability to meet exchange requirements or change which tax strategies make sense for your situation.

Always consult your CPA. Tax implications vary based on your specific circumstances: How long you’ve owned the property, whether it’s your primary residence, your income level, and your overall tax situation all influence how concessions affect your return. This guide provides general information only—rely on a qualified tax professional for advice on your particular sale.

Frequently Asked Questions About Seller Concessions

Do seller concessions lower my home’s sale price?

Not officially. The purchase price remains what’s stated in the contract—say, $700,000. However, if you provide $20,000 in concessions, your net proceeds are effectively $680,000. For appraisal and marketing purposes, the sale price stays at $700,000, but your actual proceeds are reduced by the concession amount.

Can I refuse to offer concessions?

Absolutely. Concessions are negotiable, not required. In Staten Island’s current market, you might face buyer requests—particularly from FHA/VA purchasers—but you’re under no obligation to agree. Your decision should balance market conditions, buyer pool characteristics, and your timeline against the financial impact of conceding.

How do seller concessions affect the appraisal?

Appraisers review purchase contracts and note concession amounts. Large concessions (5%+) may trigger scrutiny if the appraiser suspects the purchase price was inflated to accommodate them. In such cases, the appraised value might come in below the contract price, requiring the buyer to increase their down payment or renegotiate. Keep concessions reasonable relative to comparable sales to avoid appraisal complications.

Are seller concessions taxable to the buyer?

No. The IRS doesn’t treat seller concessions as taxable income to buyers. Instead, concessions reduce the buyer’s cost basis in the property (what they “paid” for it), which can affect their capital gains tax when they eventually sell. But at the time of purchase, buyers receive concessions tax-free.

What if my buyer’s closing costs are less than the concession amount?

The concession automatically reduces to match actual closing costs. If you agreed to $25,000 in concessions but the buyer’s documented costs total only $20,000, you’ll be credited $20,000 on the settlement statement. The excess $5,000 disappears—it cannot be refunded to the buyer as cash or applied to their down payment. This rule prevents buyers from inflating concession requests to extract cash at closing.

See Your True Net Proceeds After Concessions

Seller concessions significantly impact your bottom line—but the exact effect depends on your specific sale price, loan type, and negotiation strategy. Wonder how a 3% concession would affect your proceeds compared to a 2% price reduction?

Get a free net proceeds analysis from Robert DeFalco Realty. Our team will model multiple scenarios—including concessions, price adjustments, and timing considerations—showing you precisely what you’ll net at closing under different strategies.

Contact our Staten Island specialists today:

- Custom net proceeds calculator factoring in concessions, taxes, and commissions

- Current concession trends for your neighborhood and price point

- Strategic advice on when to offer concessions versus holding firm

- Expert negotiation support throughout your sale

With 40+ years serving Staten Island sellers and direct SIMLS access, we know exactly how to structure concessions that close deals while protecting your equity. Let’s build a winning strategy for your sale.

Get Your Free Seller Consultation →

Related Resources for Staten Island Sellers

- NYC Mansion Tax: Complete Guide for Sellers

- How to Sell Your Staten Island Home Fast

- Selling a House in New York: Complete Guide

- Home Staging Tips: Ultimate Guide for NYC & NJ Sellers

- Understanding Closing Costs in New Jersey

This article provides general information about seller concessions in New York and is not legal, financial, or tax advice. Consult with licensed professionals—including your real estate attorney and CPA—regarding your specific situation. Market conditions and regulations change; verify all information before making decisions.

About Robert DeFalco Realty: Staten Island’s leading real estate brokerage serving the New York and New Jersey metro area since 1985. Our experienced agents provide expert guidance on pricing, negotiations, and closing strategies for sellers throughout all five boroughs.