Closing costs in New Jersey range from 2% to 5% of the purchase price for buyers and 8% to 10% of the sale price for sellers as of September 2025. For a median-priced $533,300 home, buyers typically pay between $10,666 and $26,665, while sellers pay $42,664 to $53,330 in total closing expenses.

Understanding these costs before entering New Jersey’s competitive real estate market helps buyers and sellers budget accurately and avoid closing day surprises. This comprehensive guide covers current closing cost breakdowns, county-specific variations, and proven strategies to reduce expenses across all 21 New Jersey counties.

Understanding Closing Costs in New Jersey

Closing costs represent the fees and expenses required to complete a real estate transaction and legally transfer property ownership from seller to buyer. In New Jersey, these costs encompass 5 key components: mortgage-related fees, title services, government taxes, professional services, and prepaid expenses.

New Jersey operates as an attorney state, meaning real estate attorneys handle most closing procedures rather than title companies alone. This requirement adds legal protection but increases costs compared to other states. The average closing costs in New Jersey rank among the highest in the nation at 1.7% of the home’s sale price according to CoreLogic’s ClosingCorp data.

Total closing costs in New Jersey are split unequally between buyers and sellers. Sellers shoulder the majority of expenses, primarily due to real estate agent commissions averaging 5.23% statewide. Buyers focus on mortgage-related costs, title insurance, and various transaction fees.

The actual amount varies significantly based on home price, loan type, county location, and negotiated seller concessions. Properties in high-value counties like Bergen and Hunterdon typically generate higher absolute costs, while properties in urban areas may have additional municipal fees.

Buyer Closing Costs in New Jersey

New Jersey home buyers pay approximately 2% to 5% of the purchase price in closing costs. On the current median home price of $533,300, this translates to $10,666 to $26,665 in total expenses paid at closing.

Primary Buyer Closing Costs in New Jersey

Loan Origination Fees (0.5% to 1%) Most lenders charge origination fees for processing mortgage applications. For a $400,000 loan, expect $2,000 to $4,000 in origination costs.

Appraisal Fees ($400 to $600) Lenders require professional appraisals to verify property values before approving mortgages. Appraisal costs in New Jersey average $500 for standard single-family homes.

Home Inspection ($500 to $800) Professional inspections identify potential property issues before purchase. Comprehensive inspections including pest, radon, and well testing can reach $1,200 in certain areas.

Title Insurance and Search ($800 to $2,000) Title insurance protects buyers from ownership disputes and liens. New Jersey buyers typically pay for both lender’s and owner’s title insurance policies.

Real Estate Attorney Fees ($1,200 to $2,500) Attorney representation during New Jersey real estate transactions provides contract review, title examination, and closing coordination. Our experienced New Jersey agents work with trusted attorneys throughout the process.

Recording Fees ($100 to $300) County recording offices charge fees to officially document property transfers and mortgage liens in public records.

Property Taxes (Prorated) Buyers pay property taxes from closing date through year-end. New Jersey’s average property tax rate of 1.99% creates substantial prorated amounts, particularly for fall closings.

Homeowners Insurance ($800 to $2,000 annually) Lenders require first-year premium payments at closing. Flood insurance may add $400 to $1,200 annually for properties in flood zones.

Private Mortgage Insurance (0.3% to 1.5% annually) Buyers with down payments below 20% pay PMI. For a $400,000 loan, annual PMI ranges from $1,200 to $6,000.

Credit Report and Processing Fees ($50 to $150) Lenders charge administrative fees for credit checks, document processing, and underwriting services.

Survey Costs ($500 to $1,500) Property surveys verify boundary lines and identify encroachments. Complex lots or commercial properties may require $2,000+ surveys.

Prepaid Interest and Escrow Deposits Lenders collect several months of property taxes, insurance, and mortgage interest at closing to establish escrow accounts.

Closing Costs for Cash Buyers in New Jersey

Cash buyers in New Jersey pay significantly lower closing costs, typically 1% to 2% of the purchase price. Cash transactions eliminate mortgage-related fees including origination charges, appraisals, and PMI requirements.

Cash buyers still pay attorney fees, title insurance, recording costs, and prorated property taxes. The streamlined process often reduces total costs to $5,000 to $15,000 on median-priced homes.

Seller Closing Costs in New Jersey

Seller closing costs in New Jersey average 8% to 10% of the home’s sale price. For a $533,300 median-priced home, sellers pay approximately $42,664 to $53,330 in total expenses.

Primary Seller Closing Costs in New Jersey

Real Estate Commissions (5.23% average) Realtor fees represent the largest seller expense in New Jersey. The statewide average includes 2.71% for listing agents and 2.52% for buyer’s agents. On a $500,000 sale, total commissions reach $26,150.

Following the recent NAR settlement, sellers maintain flexibility in commission negotiations and buyer agent compensation structures. Contact Robert DeFalco Realty to explore competitive commission options.

Transfer Taxes (0.8% to 1.5%) New Jersey charges a realty transfer fee of $2 for each $500 of consideration, effectively 0.4% of the sale price. Additional local transfer taxes in municipalities like Newark, Jersey City, and others can increase total transfer costs to 1.5% of the sale price.

Property Taxes (Prorated) Sellers pay property taxes through the closing date. With New Jersey’s high property tax rates, prorated amounts can reach $8,000 to $15,000 depending on closing timing and location.

Real Estate Attorney Fees ($1,500 to $3,000) Seller attorneys handle contract preparation, title clearance, and closing coordination. Experienced attorneys ensure smooth transactions and proper documentation.

Title Insurance (Owner’s Policy) ($600 to $1,500) Sellers typically purchase owner’s title insurance policies protecting buyers from ownership defects. Costs vary based on property value and title company selection.

Recording Fees and Document Preparation ($200 to $500) Various recording fees, deed preparation costs, and municipal requirements add administrative expenses to seller closing costs.

Mortgage Payoff and Satisfaction ($100 to $300) Sellers pay outstanding mortgage balances plus accrued interest through closing. Satisfaction recording fees officially release mortgage liens.

Seller Concessions and Buyer Incentives Many sellers offer concessions covering buyer closing costs or home repairs. Buyer incentives in New Jersey average 2% of the sale price in competitive markets.

Who Pays Closing Costs on a House in New Jersey

New Jersey follows traditional cost allocation where sellers pay real estate commissions and transfer taxes while buyers handle mortgage-related expenses. However, many costs are negotiable between parties.

Common negotiated items include:

- Home warranty premiums

- Pest inspection costs

- Repair credits

- Attorney fee splits

- Title insurance selections

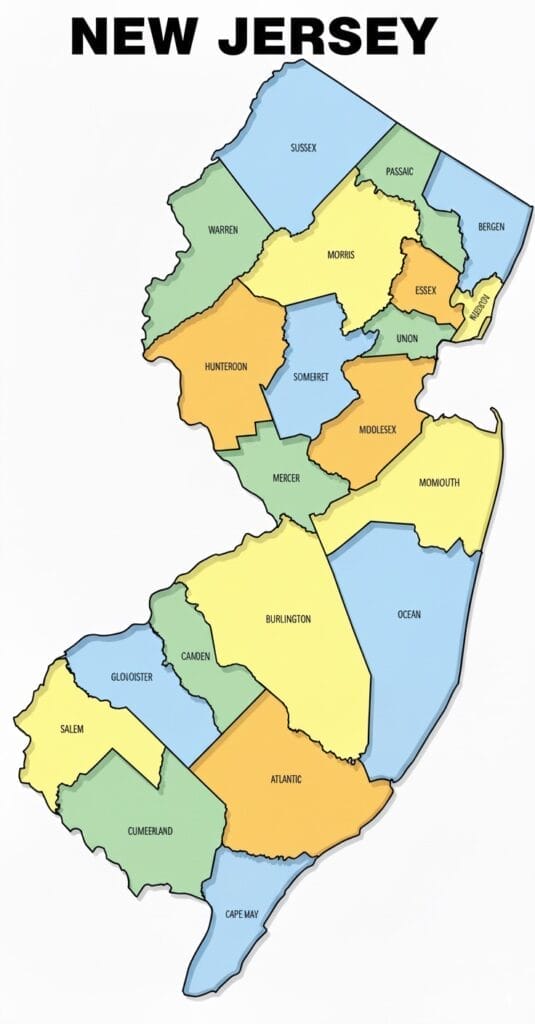

County-by-County Closing Cost Variations

Closing costs vary significantly across New Jersey’s 21 counties due to different property tax rates, local transfer fees, and recording costs. Understanding county-specific variations helps buyers and sellers budget accurately.

Bergen County

Bergen County homebuyers face higher-than-average closing costs due to elevated property values and municipal fees. Property tax rates average 1.47% of assessed value, below the state average but applied to higher-value homes.

Transfer taxes in Bergen County municipalities range from the state minimum 0.4% to 1.2% in certain townships. Bergen County recording fees average $150 for standard transactions.

Essex County

Essex County, including Newark and surrounding communities, imposes additional municipal transfer taxes reaching 1% of sale price. Combined with state fees, total transfer costs reach 1.4% in many Essex municipalities.

Property tax rates in Essex County average 2.8%, creating substantial prorated amounts for buyers and sellers. Newark specifically charges additional documentary stamps on real estate transfers.

Morris County

Morris County closing costs remain closer to state averages with property tax rates averaging 2.1%. Most municipalities impose minimal additional transfer fees beyond state requirements.

Morris County’s efficient recording system keeps documentation costs relatively low at $100 to $200 for standard residential transactions.

Hudson County

Hudson County, encompassing Jersey City and Hoboken, features some of New Jersey’s highest closing costs. Jersey City imposes a 1% municipal transfer tax in addition to state fees.

Property tax rates vary dramatically within Hudson County, from 0.9% in some areas to 3.5% in others. High-rise condominiums often include additional transfer fees and association requirements.

Monmouth County

Monmouth County offers moderate closing costs with property tax rates averaging 1.8%. Coastal communities may require additional flood insurance and environmental certifications.

Recording fees in Monmouth County average $125 with streamlined processing for residential transactions.

For detailed neighborhood insights across New Jersey, explore our comprehensive New Jersey market analysis.

Closing Cost Reduction Strategies

Reducing closing costs requires strategic planning and effective negotiation. New Jersey buyers and sellers can implement 7 proven strategies to minimize transaction expenses.

Negotiate Seller Concessions

Seller concessions allow sellers to pay portions of buyer closing costs. FHA loans permit up to 6% seller contributions, while conventional loans allow 3% to 6% depending on down payment amounts.

Effective concession negotiations often involve adjusting purchase prices to accommodate seller contributions. For example, increasing a $400,000 offer to $410,000 with $10,000 seller concessions may benefit both parties.

Shop for Service Providers

Comparison shopping for attorneys, title companies, and inspectors can reduce costs substantially. Page 2 of your Loan Estimate identifies services you can shop for independently.

Attorney fees in New Jersey range from $1,200 to $3,500. Obtaining multiple quotes and negotiating flat-fee arrangements often reduces legal expenses.

Leverage Down Payment Assistance Programs

The New Jersey Housing and Mortgage Finance Agency (NJHMFA) provides up to $15,000 in down payment and closing cost assistance for qualified first-time homebuyers. This interest-free, forgivable loan significantly reduces upfront costs.

Additional county and municipal programs offer supplemental assistance. Essex County, Hudson County, and Camden provide local first-time buyer benefits.

Time Your Closing Strategically

Closing timing affects prorated costs substantially. Closing early in the month reduces prepaid interest charges, while closing late in the tax year minimizes prorated property tax obligations.

December closings often provide the best proration benefits, particularly in high-tax municipalities where annual obligations exceed $20,000.

Request Lender Credits

Many lenders offer closing cost credits in exchange for slightly higher interest rates. A 0.25% rate increase might provide $2,000 to $3,000 in upfront cost reduction.

Calculate the long-term cost impact before accepting lender credits. Higher rates may cost more over the loan term than upfront savings provide.

Bundle Services

Some title companies and attorneys offer package pricing for combined services. Bundling title insurance, attorney representation, and settlement services can reduce total costs by $500 to $1,000.

Choose Generic Title Insurance

Title insurance costs vary between providers and coverage levels. Basic coverage often costs $300 to $500 less than enhanced policies while providing adequate protection for standard transactions.

Special Situations and Loan Types

Different loan types and property situations create varying closing cost structures in New Jersey. Understanding these variations helps buyers select optimal financing and prepare accurate budgets.

FHA Loan Closing Costs

FHA loans in New Jersey permit 3.5% down payments but require upfront and monthly mortgage insurance premiums. Upfront mortgage insurance costs 1.75% of the loan amount, typically financed into the mortgage.

Monthly mortgage insurance ranges from 0.45% to 1.05% annually depending on loan-to-value ratios and loan terms. For a $400,000 FHA loan, annual MIP costs $1,800 to $4,200.

FHA loans allow higher seller concessions up to 6% of purchase price, helping offset mortgage insurance costs. Learn more about FHA requirements from HUD’s official guidance.

VA Loan Benefits

Veterans Affairs loans eliminate down payment requirements and prohibit lender-charged origination fees exceeding 1%. VA loans also prohibit PMI requirements, reducing monthly costs substantially.

VA buyers pay funding fees ranging from 1.4% to 3.6% of loan amounts depending on service history and down payment amounts. Disabled veterans receive funding fee exemptions.

New Construction Closing Costs

New construction homes often include builder incentives covering portions of closing costs. Builders may offer $5,000 to $15,000 credits for using preferred lenders and title companies.

New construction closings may require additional inspections, utility connections, and warranty registrations. Total closing costs typically match resale home costs despite builder incentives.

Investment Property Considerations

Investment property purchases require larger down payments (typically 20% to 25%) and higher interest rates. Closing costs remain similar to owner-occupied purchases but spread across higher loan amounts.

Investors cannot use most first-time buyer assistance programs. However, 1031 exchanges may defer capital gains taxes when purchasing replacement investment properties.

Cash vs. Financed Purchase Comparison

Cash purchases eliminate mortgage-related costs including:

- Loan origination fees ($2,000 to $4,000)

- Appraisal requirements ($400 to $600)

- Mortgage insurance ($1,200+ annually)

- Credit report and processing fees ($100 to $300)

Cash buyers still pay attorney fees, title insurance, recording costs, and property taxes. Total cash buyer closing costs average $8,000 to $15,000 on median-priced homes.

New Jersey Assistance Programs

First-time homebuyers in New Jersey access multiple assistance programs reducing down payment and closing cost burdens. These programs make homeownership achievable for moderate-income families across the state.

NJHMFA First-Time Homebuyer Programs

The New Jersey Housing and Mortgage Finance Agency offers comprehensive first-time buyer assistance through competitive loan programs and down payment grants.

First-Time Homebuyer Mortgage Program provides 30-year fixed-rate government-insured loans (FHA/VA/USDA) with below-market interest rates. Qualified buyers access rates typically 0.25% to 0.75% below conventional market rates.

Down Payment Assistance Program provides up to $15,000 based on property county. This interest-free, five-year forgivable loan requires no monthly payments and disappears if buyers remain in homes for five years.

Income limits vary by county and family size. Most New Jersey counties permit household incomes up to $150,000 for first-time buyers, with higher limits in Urban Target Areas.

County and Municipal Programs

Essex County provides additional $5,000 down payment assistance for qualified homebuyers purchasing in designated revitalization areas. Camden offers similar programs with $7,500 grants.

Hudson County features employer-assisted housing programs partnering with major corporations to provide employee homebuying benefits. Jersey City offers tax abatements reducing property tax burdens for new homeowners.

Eligibility Requirements

First-time buyer status requires no homeownership within the previous three years. Divorced individuals qualify regardless of previous ownership with former spouses.

Income limits depend on area median income and family size. Most programs target households earning 80% to 120% of area median income, accommodating middle-class families.

Credit score requirements typically start at 620 for most assistance programs, though some accept scores as low as 580 with compensating factors.

For comprehensive assistance program information, visit the New Jersey Housing and Mortgage Finance Agency website.

Closing Process Timeline

New Jersey real estate closings typically require 30 to 45 days from contract execution to settlement. Understanding the timeline helps buyers and sellers prepare required documentation and coordinate professional services.

Days 1-7: Contract and Attorney Review

New Jersey law provides a three-day attorney review period following contract execution. During this time, attorneys can modify or cancel contracts without penalty.

Buyers should engage real estate attorneys immediately after contract signing. Mortgage pre-approval should be completed before house hunting to expedite the process.

Days 8-21: Mortgage Processing and Inspections

Loan applications trigger underwriting processes requiring income documentation, asset verification, and property appraisals. Buyers should respond quickly to lender requests to avoid delays.

Home inspections occur during this period, typically within 10 days of contract execution. Inspection results may trigger repair negotiations or contract modifications.

Days 22-30: Final Approvals and Preparations

Clear to close approval requires satisfactory property appraisals, title searches, and final underwriting approval. Lenders issue Closing Disclosure statements at least three days before closing.

Final walk-through inspections occur 24 to 48 hours before closing, ensuring property condition matches contract expectations and requested repairs are completed.

Closing Day: Settlement and Transfer

New Jersey closings typically occur at attorney offices or title company locations. Buyers should arrive with certified funds for closing costs and down payments.

Settlement statements detail all costs and credits. After document signing and fund transfers, buyers receive keys and official property ownership.

For detailed guidance throughout the closing process, contact our experienced team at Robert DeFalco Realty.

Frequently Asked Questions

How much are closing costs when buying a house in New Jersey?

Closing costs for buyers in New Jersey typically range from 2% to 5% of the home’s purchase price. On a median-priced $533,300 home, buyers can expect to pay between $10,666 and $26,665 in total closing costs. The exact amount depends on loan type, property location, and selected services.

What closing costs do sellers pay in New Jersey?

Sellers in New Jersey pay approximately 8% to 10% of the home’s sale price in closing costs. This includes real estate commissions averaging 5.23%, transfer taxes, attorney fees, and other settlement expenses. On a $500,000 sale, total seller costs typically reach $40,000 to $50,000.

Do I need an attorney to close on a house in New Jersey?

While not legally required, using a real estate attorney is highly recommended in New Jersey. Attorney fees typically range from $1,200 to $2,500 and provide essential protection during property transactions. Attorneys handle contract review, title examination, and closing coordination.

How much is the transfer tax in New Jersey?

New Jersey charges a realty transfer fee of $2 for each $500 of consideration, effectively 0.4% of the sale price. Many municipalities impose additional transfer taxes ranging from 0.1% to 1%. Combined transfer costs typically total 0.8% to 1.5% of the property sale price.

Can sellers help pay closing costs in New Jersey?

Yes, sellers can contribute toward buyer closing costs in New Jersey. FHA loans allow up to 6% seller contributions, while conventional loans typically permit 3% to 6% depending on the buyer’s down payment amount. These contributions are negotiated during contract discussions.

When do you pay closing costs in New Jersey?

Closing costs are paid on the closing date when property ownership transfers. Buyers typically pay via certified check or wire transfer, while seller costs are deducted from sale proceeds. The exact amount is detailed in the Closing Disclosure received three days before closing.

Are there programs to help with closing costs in New Jersey?

Yes, the New Jersey Housing and Mortgage Finance Agency (NJHMFA) offers up to $15,000 in down payment and closing cost assistance for qualified first-time homebuyers. Additional county and municipal programs provide supplemental assistance. Visit the NJHMFA website for current program details.

What’s included in closing costs for cash buyers in New Jersey?

Cash buyers in New Jersey pay approximately 1% to 2% of the purchase price in closing costs, including attorney fees, title insurance, recording fees, and property taxes. Cash purchases eliminate mortgage-related costs like origination fees, appraisals, and PMI requirements.

How can I estimate my closing costs in New Jersey?

Use online closing cost calculators for preliminary estimates, but request Loan Estimates from lenders for accurate projections. These federally-required documents detail expected costs based on your specific loan and property details.

What’s the difference between buyer and seller closing costs?

Buyers primarily pay mortgage-related costs including origination fees, title insurance, and prepaid expenses totaling 2% to 5% of purchase price. Sellers pay real estate commissions and transfer taxes totaling 8% to 10% of sale price. Some costs like attorney fees may be split between parties.

Ready to Navigate New Jersey Closing Costs?

Understanding closing costs in New Jersey empowers buyers and sellers to budget accurately and negotiate effectively. Whether you’re purchasing your first home or selling an investment property, professional guidance ensures smooth transactions and optimal outcomes.

Robert DeFalco Realty brings over 30 years of New Jersey real estate expertise to every transaction. Our experienced team understands local market conditions, county-specific requirements, and effective cost reduction strategies.

From first-time buyer guidance to complex investment transactions, we provide comprehensive support throughout the closing process. Our network of trusted attorneys, lenders, and inspectors ensures competitive pricing and professional service.

Contact Robert DeFalco Realty today to discuss your New Jersey real estate goals and receive personalized guidance on closing costs, market timing, and property selection. Let our proven expertise help you achieve successful homeownership or optimal sale proceeds in New Jersey’s dynamic real estate market.

For additional insights into New Jersey real estate trends and market analysis, explore our comprehensive tri-state area housing market reports and neighborhood guides.