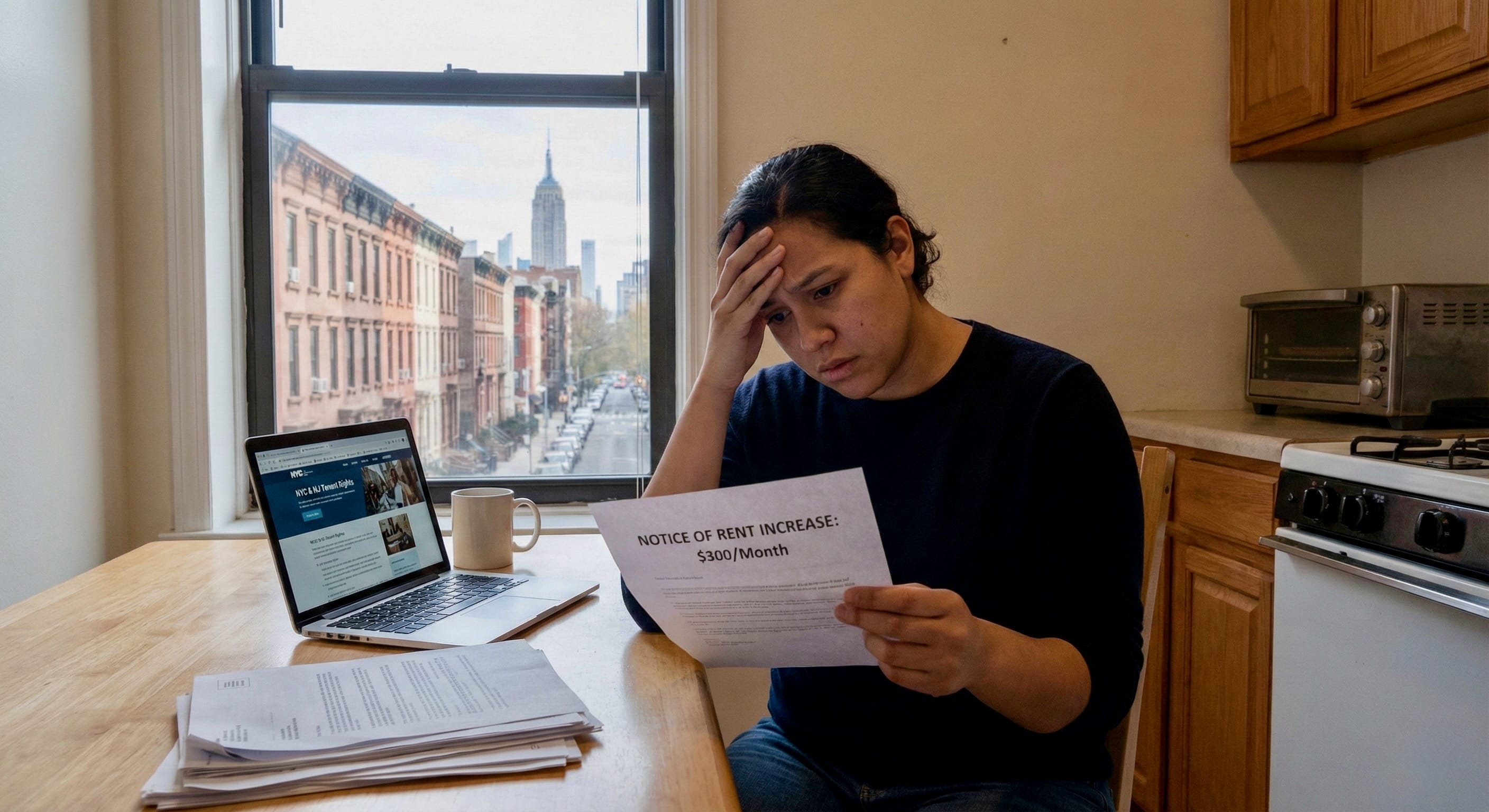

Can my landlord raise my rent $300 dollars? This question worries tenants across New York and New Jersey, especially when renewal notices arrive with unexpected increases. The short answer: it depends on your apartment type, location, and lease terms.

For tenants in the NYC metro area, understanding rent increase laws could save you hundreds or thousands of dollars each year. This guide explains when landlords can legally raise rent by $300 or more, what protections exist for different apartment types, and what steps you can take if you receive a large rent increase.

Table of Contents

Understanding Rent Increase Laws: The Basics

Before diving into specific rules, understand the two main categories of rental housing:

Market-Rate Apartments: Landlords can raise rent to any amount they choose when your lease expires. No legal cap limits the increase. A $300 increase is legal. A $500 increase is legal. Even doubling your rent is technically legal with proper notice.

Rent-Regulated Apartments: Strict limits control how much landlords can raise rent each year. These include rent-stabilized and rent-controlled units in NYC, plus apartments in municipalities with local rent control ordinances.

| Apartment Type | Rent Increase Limits | Notice Required |

|---|---|---|

| Market-Rate (NY) | No limit | 30-90 days depending on tenancy |

| Rent-Stabilized (NYC) | 3% (1-year) / 4.5% (2-year) for 2025-2026 | At lease renewal |

| Rent-Controlled (NYC) | Based on RGB formula (typically 1-7.5%) | As determined by DHCR |

| NJ Municipal Rent Control | Varies (typically 2-6%) | One month minimum |

| NJ Market-Rate | No limit | One month for month-to-month |

Can My Landlord Raise My Rent $300 Dollars in New York?

Whether your landlord can raise your rent $300 dollars in New York depends entirely on your apartment’s regulatory status.

Rent-Stabilized Apartments in NYC

If you live in a rent-stabilized apartment, your landlord cannot raise your rent by $300 unless your current rent is extremely high. The NYC Rent Guidelines Board sets maximum increases each year.

2025-2026 Rent Guidelines (Leases from October 1, 2025 – September 30, 2026):

- One-year lease renewal: 3% maximum increase

- Two-year lease renewal: 4.5% maximum increase

For a $300 increase to fall within these guidelines, your rent would need to be:

- At 3%: $10,000/month (3% of $10,000 = $300)

- At 4.5%: $6,667/month (4.5% of $6,667 = $300)

For most rent-stabilized tenants paying typical NYC rents, a $300 increase exceeds legal limits.

How to Check if You’re Rent-Stabilized:

- Buildings built before 1974 with six or more units are often rent-stabilized

- Your landlord must provide a rent history

- Contact NYS Homes and Community Renewal (DHCR) to verify status

- As of January 2026, landlords must post signs identifying rent-stabilized units

Rent-Controlled Apartments

Rent control applies to tenants who have lived continuously in the same apartment since July 1, 1971 (or succeeded to that tenancy). These units are rare but offer the strongest protections.

Rent increases for controlled apartments follow formulas based on:

- Recent Rent Guidelines Board orders

- Maximum increases of 7.5%

A $300 increase would likely exceed these limits for most rent-controlled tenants.

Market-Rate Apartments

For market-rate apartments in New York, landlords face no cap on rent increases. The question changes from “can my landlord raise my rent $300 dollars” to “did my landlord follow proper notice procedures?”

Notice Requirements (New York):

- Tenancy under 1 year: 30 days notice for increases over 5%

- Tenancy 1-2 years: 60 days notice for increases over 5%

- Tenancy over 2 years: 90 days notice for increases over 5%

If your landlord provides proper notice, a $300 increase on a market-rate apartment is legal regardless of how unfair it feels.

For tenants exploring homeownership as an alternative to rising rents, consider checking Staten Island homes for sale or Brooklyn listings where monthly costs may be comparable to rent.

Can My Landlord Raise My Rent $300 Dollars in New Jersey?

New Jersey lacks statewide rent control, but over 100 municipalities have their own ordinances. Your protections depend on where you live.

NJ Municipalities With Rent Control

If your apartment falls under local rent control, increases are limited. Here are examples:

| Municipality | Rent Increase Cap |

|---|---|

| Jersey City | CPI or 4%, whichever is lower |

| Newark | CPI, maximum 4% |

| Elizabeth | 3% (with $20 limit in some cases) |

| Edison | 5% maximum |

| Paterson | 5% (3.5% for seniors/disabled) |

| Lakewood | 6.5% (landlord pays heat) or 5% (tenant pays) |

| Atlantic City | Based on CPI |

In Jersey City or Newark, a $300 increase would be illegal for most rent-controlled units. At 4%, your rent would need to exceed $7,500/month for a $300 increase to be legal.

NJ Market-Rate Apartments

If your rental is not covered by local rent control, New Jersey law allows landlords to raise rent to any “fair and reasonable” amount. Courts have rarely defined what constitutes unreasonable, giving landlords significant latitude.

Notice Requirements (New Jersey):

- Month-to-month tenancy: One month written notice

- Fixed-term lease: Notice before lease expires (at least one month)

The Anti-Eviction Act protects you from arbitrary eviction, but it does not cap rent increases for market-rate units.

Finding Out if Your NJ Apartment Has Rent Control

Contact your municipal clerk to determine if rent control applies to your unit. Not all apartments in rent-controlled municipalities are covered. Common exemptions include:

- New construction (within certain timeframes)

- Owner-occupied buildings with fewer than specified units

- Certain subsidized housing

What Makes a $300 Rent Increase Legal or Illegal?

Understanding legality helps you respond appropriately to rent increases.

Legal $300 Increases

Your landlord can legally raise your rent $300 if:

- You have a market-rate apartment in an area without rent control

- Your lease is expiring (landlords cannot raise rent mid-lease unless the lease allows it)

- Proper notice was provided (30-90 days depending on jurisdiction and tenancy length)

- The increase follows any applicable rent control formula (if your current rent is high enough that $300 falls within percentage limits)

Illegal $300 Increases

The increase may be illegal if:

- You have a rent-stabilized or rent-controlled apartment and $300 exceeds the allowed percentage

- Your landlord did not provide proper notice

- The increase happens mid-lease without a clause allowing it

- The increase is retaliatory (punishment for complaining about conditions or exercising legal rights)

- The increase is discriminatory (targeting you based on protected characteristics)

- Your municipality has rent control and $300 exceeds the local cap

Steps to Take If You Receive a Large Rent Increase

When you receive a rent increase notice, take these steps:

Step 1: Identify Your Apartment Type

Determine whether your apartment is:

- Rent-stabilized

- Rent-controlled

- Subject to local municipal rent control

- Market-rate with no restrictions

For NYC apartments, request your rent history from DHCR. For New Jersey, contact your municipal clerk.

Step 2: Calculate the Percentage Increase

Divide the increase by your current rent:

- $300 increase on $1,500 rent = 20% increase

- $300 increase on $2,000 rent = 15% increase

- $300 increase on $3,000 rent = 10% increase

Compare this percentage to any applicable limits.

Step 3: Check Notice Requirements

Verify that your landlord provided adequate notice. In New York, long-term tenants require 60-90 days notice for large increases. In New Jersey, at least one month is standard.

Step 4: Document Everything

Keep copies of:

- Your current and proposed lease

- The rent increase notice

- Any communication with your landlord

- Your apartment’s rent history (for regulated units)

Step 5: Respond Appropriately

If the increase appears illegal: File a complaint with the appropriate agency:

- NYC: NYS Homes and Community Renewal (DHCR)

- NJ: Local rent control board or municipal offices

If the increase is legal but unaffordable: You have options:

- Negotiate with your landlord

- Look for alternative housing

- Consider whether homeownership makes financial sense

For tenants whose rents now exceed mortgage costs, exploring first-time homebuyer programs in NY and NJ might reveal affordable paths to ownership.

Negotiating With Your Landlord

Even when a $300 increase is legal, you can often negotiate a lower increase.

Arguments for Negotiation

Present a case for a smaller increase:

You’re a good tenant: Long-term tenants with clean payment histories and no complaints save landlords money on turnover costs. Finding new tenants costs landlords $3,000-$5,000 in advertising, vacancy loss, cleaning, and repairs.

You’ll sign a longer lease: Offer to sign a two-year lease in exchange for a smaller increase. Landlords value the certainty of locked-in tenancy.

Market comparisons: Research comparable apartments in your area. If similar units rent for less, present this evidence.

Current vacancies: In markets with high vacancy rates, landlords have less negotiating power. Point to empty units in your building or neighborhood.

Negotiation Tips

- Start the conversation early (before signing the new lease)

- Be polite and professional

- Have specific numbers in mind (what increase would you accept?)

- Get any agreement in writing

Tenant Protections Against Excessive Increases

Even in market-rate apartments, certain protections exist.

Retaliation Protections

Landlords cannot raise rent in retaliation for:

- Complaining about housing conditions

- Reporting code violations to city agencies

- Organizing with other tenants

- Exercising legal rights

If you recently complained about conditions and then received a large rent increase, document the timeline. Retaliatory rent increases may be challengeable.

Anti-Discrimination Protections

Rent increases cannot target you based on:

- Race or ethnicity

- Religion

- National origin

- Sex or gender identity

- Familial status (having children)

- Disability

- Other protected characteristics

If you believe discrimination motivates your rent increase, contact the NYC Commission on Human Rights or the NJ Division on Civil Rights.

Proper Notice Requirements

Your protection includes receiving proper notice. If your landlord fails to provide adequate notice, you may have grounds to challenge the increase or gain additional time to decide.

The Financial Reality: Rent vs. Own

When facing a $300 rent increase, many tenants reconsider the rent vs. buy calculation.

Sample Comparison

Consider a tenant paying $2,500/month who receives a $300 increase:

- New rent: $2,800/month

- Annual rent: $33,600

A comparable mortgage payment on a Queens home or Staten Island property might be:

- Monthly payment: $2,800-$3,200 (including taxes and insurance)

- Building equity each month instead of paying landlord’s mortgage

- Tax benefits from mortgage interest deduction

- Stable payment (fixed-rate mortgage doesn’t increase yearly)

For renters in Manhattan or Brooklyn paying $3,500+ in rent, similar calculations often favor homeownership.

Getting Started With Homeownership

If homeownership interests you, take these first steps:

- Check your credit score

- Calculate how much you can afford

- Get mortgage preapproval

- Explore down payment options

Understanding first-time homebuyer mistakes helps you avoid common pitfalls.

2026 Changes to Rent Laws

Stay informed about changes that may affect your rights.

NYC Rent Transparency Act (Effective January 2026)

Landlords must now post signs in common areas identifying rent-stabilized units. This makes it easier for tenants to verify their apartment’s status and rights.

Proposed NJ Legislation

Several bills could change New Jersey’s landscape:

- Senate Bill 452: Would limit rent increases statewide to 5% plus CPI (or 10%, whichever is lower)

- Senate Bill 3096: Would create a Rent Control Enforcement Unit

- Assembly Bill A5432: Would define “unconscionable” rent increases

These bills may not pass, but they indicate legislative interest in tenant protections.

When to Seek Legal Help

Consider consulting a tenant rights attorney or legal aid organization if:

- You believe your rent-stabilized increase exceeds legal limits

- Your landlord failed to provide proper notice

- You suspect retaliation or discrimination

- You’re facing eviction threats alongside rent increases

- Your landlord refuses to provide rent history

Free Resources:

- NYC: Housing Court Help Centers, Legal Aid Society

- NJ: Legal Services of New Jersey (LSNJ)

Understanding Your Lease Terms

Your lease is a contract that protects both you and your landlord. Before reacting to a rent increase, review your lease carefully.

Key Lease Provisions to Check

Renewal Terms: Some leases automatically renew unless either party gives notice. Others require active renewal. Know which type you have.

Rent Escalation Clauses: Some leases include built-in rent increases. If your lease says rent increases by $100 each year, that clause is enforceable.

Term Length: A month-to-month tenancy allows more frequent increases than an annual lease. Consider requesting a longer lease term for rent stability.

Right to Renew: Rent-stabilized tenants have the right to renew their lease. Market-rate tenants typically do not, though New Jersey’s Anti-Eviction Act provides stronger protections.

Lease Negotiation at Renewal

When your lease comes up for renewal, you have negotiating opportunities:

Request a longer term: Two-year leases often come with smaller annual increases than consecutive one-year leases.

Bundle requests: If the landlord wants a $300 increase, ask for improvements in exchange. New appliances, painting, or repairs can offset the higher rent.

Propose alternatives: If you cannot afford the full increase, propose a smaller increase now with a second increase in six months.

Specific Situations and Solutions

Different circumstances call for different approaches when asking can my landlord raise my rent $300 dollars.

You Just Signed a Lease

If you signed a one-year lease three months ago, your landlord cannot raise your rent until the lease expires. Mid-lease increases are only legal if your lease specifically allows them.

You’re Month-to-Month

Month-to-month tenants face the most vulnerability. Your landlord can raise rent with just one month’s notice (30 days in NY for tenancies under one year). Consider negotiating a fixed-term lease for more stability.

Your Building Just Sold

New owners must honor existing leases. If you have six months remaining on your lease, the new owner cannot raise your rent until renewal. For rent-stabilized tenants, protections continue regardless of ownership changes.

You Live in a Two-Family Home

Small buildings often have different rules. In New Jersey, buildings with two or fewer units may be exempt from some tenant protections. In NYC, buildings with fewer than six units may not be rent-stabilized.

You’re a Senior or Have a Disability

Some municipalities offer additional protections for seniors and disabled tenants. Paterson, NJ limits increases to 3.5% for these groups. NYC has programs like SCRIE (Senior Citizen Rent Increase Exemption) and DRIE (Disability Rent Increase Exemption).

Regional Market Context

Understanding your local rental market helps you evaluate whether a $300 increase is reasonable.

NYC Metro Rental Market 2026

The NYC rental market remains competitive in many neighborhoods. Brooklyn and Manhattan rents continue to climb, while some outer-borough neighborhoods offer relative value.

Current median rents in major areas:

- Manhattan: $4,200+

- Brooklyn: $3,200+

- Queens: $2,600+

- Staten Island: $2,100+

New Jersey Rental Markets

NJ rental costs vary widely by location. Waterfront cities like Hoboken and Jersey City command premium rents, while inland areas offer more affordable options.

Bayonne provides a middle-ground option for renters priced out of neighboring cities. For those considering a move, NJ property taxes should factor into the rent vs. buy calculation.

Alternatives to Accepting the Increase

If a $300 rent increase makes your current apartment unaffordable, consider alternatives.

Find a Roommate

If your lease allows subletting or roommates, adding someone to share costs can offset the increase.

Negotiate a Shorter Lease

If you’re uncertain about staying long-term, negotiate a six-month lease. This gives you time to explore options without committing to a full year at the higher rate.

Move to a More Affordable Area

Neighborhoods on transit lines offer good value compared to prime locations. Tottenville in Staten Island provides suburban feel with NYC access.

Transition to Homeownership

For many tenants, the question “can my landlord raise my rent $300 dollars” leads to serious exploration of buying. When monthly mortgage payments match or beat rent costs, ownership provides price stability and equity building.

Consult the Staten Island real estate market update for current pricing trends.

Frequently Asked Questions

Can my landlord raise my rent $300 dollars?

In market-rate apartments without rent control, yes. Landlords can raise rent by any amount with proper notice when your lease expires. In rent-stabilized or rent-controlled apartments, a $300 increase would exceed legal limits for most tenants because percentage caps typically allow much smaller dollar increases.

What is the maximum rent increase allowed in NYC?

For rent-stabilized apartments in 2025-2026, maximum increases are 3% for one-year leases and 4.5% for two-year leases. Market-rate apartments have no maximum. Rent-controlled apartments follow separate formulas capped around 7.5%.

Can my landlord raise rent in the middle of my lease?

Generally no. Fixed-term leases lock in your rent for the lease period unless your lease includes a rent increase clause. Month-to-month tenancies allow increases with proper notice (typically 30 days to one month).

How much notice must my landlord give for a rent increase?

In New York, notice requirements depend on tenancy length: 30 days for under one year, 60 days for 1-2 years, 90 days for over two years (for increases over 5%). In New Jersey, one month notice is standard for month-to-month tenancies.

What can I do if my rent increase seems unfair?

First, determine if legal limits apply to your apartment. File a complaint if the increase exceeds those limits. If the increase is legal but unwelcome, try negotiating with your landlord. Consider exploring homeownership if rent increases make renting unsustainable.

How do I know if my apartment is rent-stabilized?

Check your lease for rent stabilization language. Request your apartment’s rent history from NYS DHCR. Buildings built before 1974 with six or more units in NYC are often rent-stabilized. As of January 2026, landlords must post signs identifying stabilized units.

Can my landlord evict me if I don’t pay the increased rent?

If you refuse a legal rent increase and don’t vacate when your lease ends, your landlord can begin eviction proceedings. In New Jersey, the Anti-Eviction Act provides stronger protections; landlords need “just cause” for eviction.

Should I buy a home instead of paying increasing rent?

This depends on your financial situation, timeline, and local market. For many NYC metro tenants, monthly mortgage payments are comparable to high rents, with the added benefit of building equity. Speak with a real estate professional to understand your options.

Next Steps

If you’re wondering “can my landlord raise my rent $300 dollars?” and the answer is yes, you have choices. You can negotiate, explore protected housing options, or consider whether homeownership makes sense for your situation.

Robert DeFalco Realty helps tenants transition to homeownership across Staten Island, Brooklyn, Manhattan, Queens, and New Jersey. Our agents understand the rent vs. buy calculation and can show you properties where monthly costs compare favorably to your current rent.

Ready to explore homeownership? Contact our team for a no-obligation consultation. Or browse current listings to see what’s available in your price range.

Sources: